When I started working first, I had lot of doubts about tax, income tax & its calculation, income tax return, filing returns and what not. So if you are someone like me starting out new, I guess this article is for you. Here I will try to explain some very basic concepts that you need to know in a simple language.

What is Tax?

First lets try to understand tax. Now there can be very technical definition with lot of Jargon, but that’s not my motive here. So I will put it in an informal and easy way.

“Tax” is basically money that you pay to the government or authority for a specific purpose. That money is mostly for the earning of government so that they can keep providing us their service and maintain their working.

Now, taxes can be of various types like income tax, capital gains tax, value added tax, direct tax, indirect tax, etc. I will write a separate article for that to explain in detail.

But let’s not lose our focus. So here as a new working person our focus is on income and income tax.

What is Income?

“Income” is simply the money that we receive in exchange of our services.

What is Income Tax?

“Income tax” is the tax that you have to pay on the income you earn.

Does everybody pay the same amount of income tax?

It is a fact that not everybody earn the same. A lot of people earn lower, and others have higher incomes.

The Income tax structure lays down government guidelines on how much tax we have to pay as percentage of our incomes. And that percentage changes with the income levels.

Now, Here comes a new term i.e. progressive taxation. To understand it simply-

“Progressive taxation” means if there is more income then more tax to pay. So if I earn more, I will have to pay more income tax.

Income tax in India is progressive in nature i.e. the richer the person, more amount of his income will go into taxes.

How Income tax is calculated in India?

In India we have a law for Income tax i.e. Income tax act,1961. Here government proposes tax to be paid as percentage of income levels.

Tax regimes in India

There are two ways of calculating Income Tax.

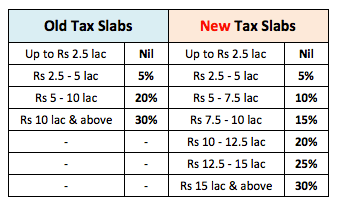

Old tax regime :- It was being followed till 2020 for IT calculation.

New tax regime :- Introduced in Budget 2020.

Both have different “Income Tax Slabs” i.e. range of income on which tax is applied.

I will put up a separate article to explain the tax regimes in detail.

It’s up to the individual to choose any regime. We have option to select tax regime while filing Income Tax Return.

How Income Tax is paid?

Most of the employers deduct income tax themselves before paying you the salary.

Also there is an option to pay advance tax scheme where you pay income tax by yourself thorough government website.

What is Income Tax Return?

It’s a form that we have to submit with income tax department after the end of a financial year. It basically contains details of our income and investments and net tax amount.

What is Tax Exemption?

Old tax regime in India gives certain exemptions on income tax. It simply means that if you invest or use your money for certain purposes, government will deduct that much amount from your taxable income. It means that you wont have to pay income tax on that amount. In India , this exemption has max limit of 1.5 lakhs.

The provision of such exemption is mentioned under section 80 C of Income Tax Act 1961.

Well I think this sums up some basic must-knows. I hope you found this article useful in some way.

Thanks you for stopping by. I appreciate your time.

nice article for guidance

thanks

Nicely elucidated Shrishti. Way to go.